A Landmark Investment in Ethiopian Birr

IFC’s First Local-Currency Loan in Ethiopia Boosts Small Business Growth

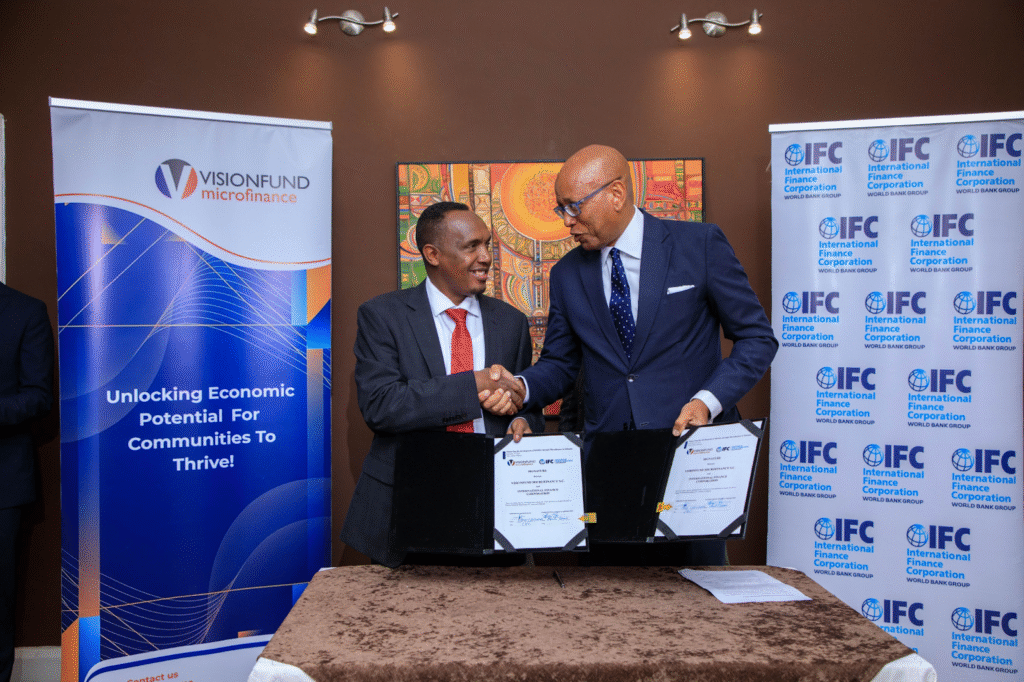

VisionFund Microfinance and IFC representatives at the signing ceremony for the landmark local-currency loan.

In a first-of-its-kind transaction in Ethiopia, the International Finance Corporation (IFC) is providing a loan denominated in Ethiopian birr to a local financial institution. IFC has committed an equivalent of $30 million in financing to VisionFund Microfinance Institution, with an initial disbursement of $10 million in Ethiopian birr. This marks the first-ever local currency loan by an international investor to Ethiopia’s financial sector. The birr-based loan will enable VisionFund – the country’s largest privately-held, deposit-taking microfinance institution – to expand credit access for micro, small, and medium-sized enterprises (MSMEs) nationwide. At least half of the funds are earmarked for women-owned businesses and entrepreneurs in rural areas, segments that have been historically underserved by lenders. By lending in local currency, IFC is shielding VisionFund and its clients from exchange rate risks, strengthening their financial resilience and sustainability.

Key highlights of the IFC–VisionFund financing:

- Historic First: Represents IFC’s first local-currency loan in Ethiopia, setting a precedent for international investment in Ethiopian birr.

- Total Commitment: Part of a planned $30 million package, comprising $20 million from IFC’s own account and $10 million mobilized from other investors. The initial tranche of $10 million (in birr) has already been disbursed.

- Focus on MSMEs & Women: Aims to expand lending to MSMEs across Ethiopia, with at least 50% of the credit dedicated to women-owned or women-led businesses and entrepreneurs in rural areas. This will help empower female entrepreneurs and drive inclusive growth.

- Mitigating Currency Risk: The financing is provided in Ethiopian birr (ETB) rather than U.S. dollars, protecting borrowers from forex fluctuations that could otherwise jeopardize small businesses. Local-currency funding ensures small enterprises aren’t exposed to devaluation risk on loans, enhancing their stability.

- Capacity Building: Alongside the loan, IFC will deliver advisory support to VisionFund to strengthen its strategic planning, risk management, and responsible finance practices. This technical assistance will support VisionFund’s planned transformation into a microfinance bank, bolstering its long-term sustainability and service delivery.

- Blended-Finance Support: The investment is backed by the World Bank Group’s IDA Private Sector Window, through its Blended Finance and Local Currency Facilities. This innovative support mechanism is designed to de-risk private investments in low-income and fragile markets, making affordable local-currency financing possible in countries like Ethiopia where such options are scarce

Expanding Credit Access to MSMEs and Women Entrepreneurs

Micro, small, and medium-sized enterprises (MSMEs) are the backbone of Ethiopia’s economy, yet access to finance remains a major constraint. Of nearly 2 million MSMEs, only 6% of micro and 1.9% of small enterprises can access formal credit, leaving a financing gap of about $4.2 billion. Women entrepreneurs face even steeper barriers—just 39% of women hold a formal bank account compared to 55% of men.

The IFC–VisionFund loan directly tackles this gap by targeting half of its new funding toward women-led businesses. By enabling VisionFund to expand lending in rural areas, where banks are scarce, the initiative empowers entrepreneurs to grow businesses, create jobs, and raise household incomes. As VisionFund CEO Taye Chimdessa noted, the funding will “empower entrepreneurs, strengthen rural economies, and bring inclusive financial services closer to families who need them most”.

The Importance of Local-Currency Lending and Significance for Economic Impact

A standout feature of the deal is its birr-denominated structure. Borrowing in foreign currency has historically exposed Ethiopian institutions to heavy exchange-rate risks, given the birr’s depreciation. IFC’s use of the IDA Private Sector Window’s Local Currency Facility eliminates this mismatch, ensuring predictable repayments and greater financial resilience. As the Ethiopian Business Review highlighted, lending in birr shields VisionFund and its clients from exchange volatility.

The transaction signals rising investor confidence in Ethiopia’s reforming financial landscape. In 2024, Ethiopia opened its banking sector to foreign participation, following earlier liberalization of telecoms. IFC’s birr-based loan demonstrates a sustainable model for bringing international capital into the system while strengthening local MFIs. For VisionFund—the largest private MFI with 117 branches nationwide the partnership also supports its transition into a regulated microfinance bank. Alongside capital, IFC is providing advisory support in risk management and digital finance, helping VisionFund scale sustainably and set best-practice benchmarks for the sector.

Ethiopia, Africa’s second-most-populous country, has rebounded to over 6% GDP growth in 2023 after recent slowdowns. Supporting MSMEs—particularly women-led businesses—is essential to sustain this growth and create jobs for the country’s young population.

The IFC–VisionFund deal, part of IFC’s $600 million investment in Ethiopia in FY2025, channels capital directly to grassroots entrepreneurs. It blends local-currency financing, gender inclusion, and institutional strengthening—making it more than just a loan. It is a milestone in Ethiopia’s push for inclusive growth, proving that international finance can align with domestic stability and opportunity.

Sources

IFC Approves $10 Million Loan for VisionFund to Boost MSME Financing, https://msmeafricaonline.com/ifc-approves-10-million-loan-for-visionfund-to-boost-msme-financing/?utm_source

IFC Issues First Local Currency Loan to Ethiopian Financial Institution, https://birrmetrics.com/ifc-issues-first-local-currency-loan-to-ethiopian-financial-institution/?utm_source

IDA Private Sector Window / Local Currency Facility Details, https://www.ifc.org/en/pressroom/2025/ifc-announces-landmark-local-currency-loan-to-support-small-business-growth-in-eth?utm_source

Ethiopian macroeconomic risk / foreign exchange pressures, https://documents1.worldbank.org/curated/en/099031224151017669/pdf/BOSIB1a04969dd03f1b2d31310f5643586b.pdf?utm_source

VisionFund Microfinance Enters $30 Million Strategic Partnership Agreement, https://visionfundmfi.com/visionfund-microfinance-enters-30-million-strategic-partnership-agreement/?utm_source

IFC Announces Landmark Local Currency Loan to Support Small Business Growth in Ethiopia, https://www.ifc.org/en/pressroom/2025/ifc-announces-landmark-local-currency-loan-to-support-small-business-growth-in-eth?utm_source

Michael D. Hailesilase